IRS Tax Whistleblower Program

To combat tax fraud and evasion, the U.S. Government created the Internal Revenue Service (IRS) whistleblower program. This program provides rewards and protections to those who expose unlawful activities. The IRS estimates that every year $450 billion dollars is underpaid in taxesby companies and individuals, which unfairly shifts the burden of federal funding onto ordinary citizens. In 2006 Congress passed the Tax Relief and Healthcare Act that was modeled after the successful False Claims Act. To date, the IRS Whistleblower Office has paid over $315 million in awards to the brave relators who helped the authorities recover illegally hidden funds.

Protection and Anonymity

People who want to blow the whistle can submit their information by hiring an attorney to represent them. Together, they will work with their attorney to organize a claim by completing IRS Form 211, attaching any relevant documents in their possession, and then sending the form to the IRS Whistleblower Office. Over the course of the investigation, the whistleblower’s identity will remain protected since the authorities will not reveal any identifying information such as their name, age, gender, or job position, except under very limited circumstances.

IRS Whistleblower Reward Provision

If the taxes, interests, and penalties exceed $2 million, the whistleblower is entitled to a payment of 15-30% of the amount collected by the IRS. The information provided by whistleblowers must be confidential, meaning that it is not commonly accessible or available in public records. Another factor that increases the amount of reward provided is how long it took the plaintiff to approach the government about the alleged illegal scheme. Also, more detailed submissions to the IRS that contain thorough legal and technical analysis of taxpayer records may help to secure a larger award.

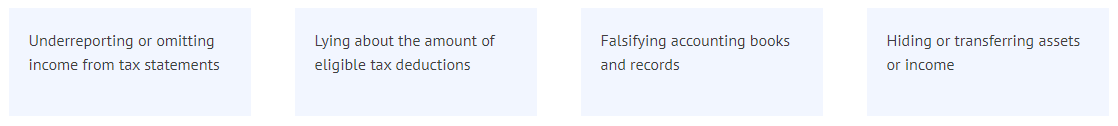

Tax Fraud Examples

The invaluable help provided by whistleblowers

To date, the IRS Whistleblower Office has awarded over $1 billion to whistleblowers, over $86 million of which have been paid in fiscal year 2020 alone. Every year the government recovers hundreds of billions in uncollected corporate taxes thanks to the help of anonymous tips. Usually, most of the information about the companies involved cannot be disclosed to protect the relator’s identity. In September 2012, however, Bradley Birkenfeld has been awarded $104 million for his role in exposing how UBS helped its clients conceal money in Swiss tax shelters.

How to report fraud under the IRS Whistleblower Program

Any individual who discovers tax fraud may file a case with the IRS. Whistleblowers do not have to be citizens and do not have to be employees of the company they are reporting. Cases must be submitted as early as possible due to the statute of limitations, which can be as short as three years. If you or someone you know possess valuable information on a company or individual cheating on their taxes, you should contact a whistleblower attorney immediately.

Submissions must be accompanied by evidence including financial data, a description of the company’s assets, copies of books and records, transaction documents, the location of bank accounts, or even the personal addresses and employment history of the persons involved in the alleged scheme.

Take the First Step

If you are unsure whether you have a whistleblower case, you should still contact an attorney as soon as possible because Statute of Limitations laws may prevent you from filing a case if too much time has passed. Your first consultation is free and totally confidential. Call us now at (800) 689-8552, or file a form by clicking the button below.

General Whistleblower news:

-

SEC Awards $250,000 to Two Whistleblowers

- Whistleblower News

One of the best tools the Securities Exchange Commission (SEC) has to help reduce fraudulent activities and protect investors is its Whistleblower Program, which provides a reward of 10%-30% of monies ...

Read More -

Money laundering, the art market, and the proposed ENABLERS Act

- Whistleblower News

Money laundering is the act of concealing the origins of money, usually of criminal origin. When people obtain funds from criminal endeavors, they must find ways to use the money in a non-suspicious ...

Read More -

Theranos whistleblower exposes widespread healthcare fraud

- Whistleblower News

The whistleblower who exposed the healthcare fraud occurring at Theranos Inc. reports a vast scheme used to manipulate lab tests and quality-control checks. Tyler Shultz is the grandson of George P. ...

Read More