Tax Fraud

The U.S. Government relies on the help of whistleblowers who report tax fraud and evasion to the Internal Revenue Service (IRS). Corporations and individuals who intentionally defraud the government by underpaying taxes commit a crime that violates Title 26 and Title 18 of the United States Code.

What is Tax Fraud?

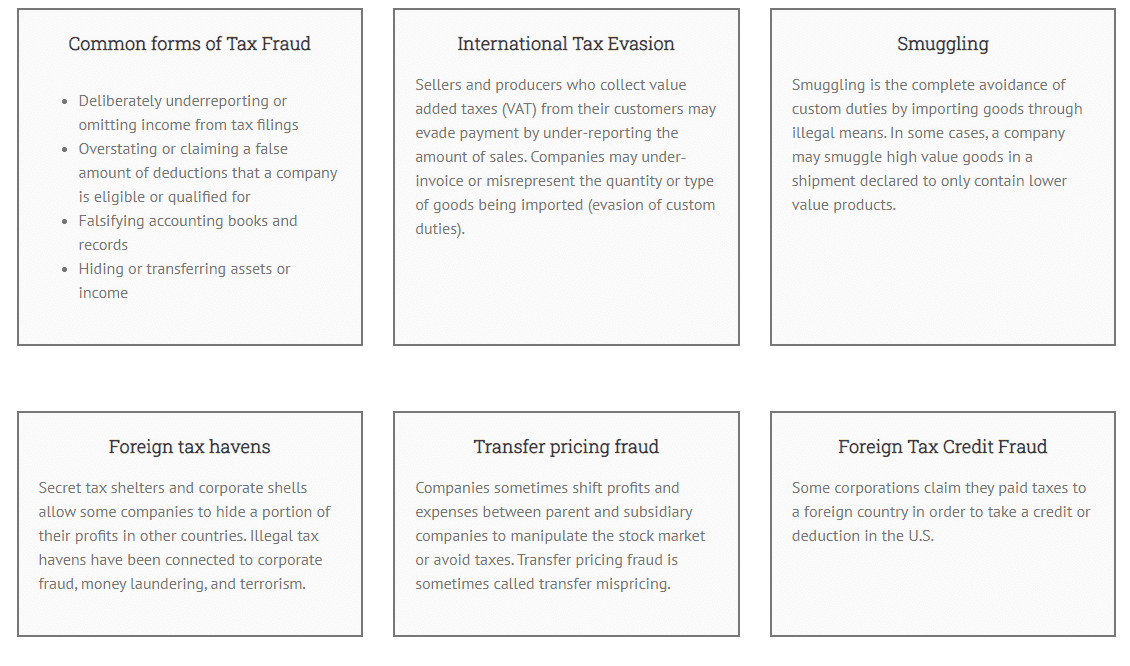

Tax fraud is the deliberate attempt to evade or defeat any tax that is lawfully due. While companies and citizens may legally seek to lower their tax burden as much as possible, outright fraud and exploiting loopholes in order to pay fewer taxes to Federal and State governments is illegal and can be reported to the IRS under the IRS whistleblower program. Those who earn income through global trade and services have also several additional methods to abuse these exploits and avoid due payments. The penalties for this type of felony include civil and criminal fines, imprisonment and back payment with interest.

Impact of Tax Fraud

The IRS estimates that tax fraud, evasion, and underpayments directly result in the Federal Government collecting $450 to $500 billion less in tax revenue each year. This gap must be bridged by either cutting funding for federal programs or by increasing the burden on law‐abiding U.S. taxpayers to generate more revenue.

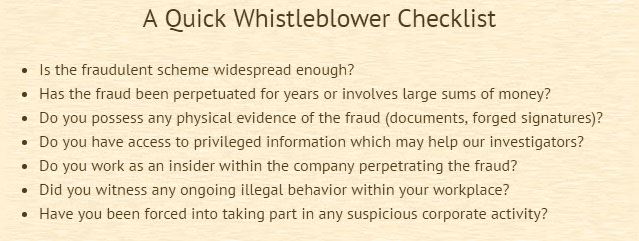

This type of fraud is difficult to detect and even harder to prove because the authorities must show that the underpayment was intentional. This could be difficult in large companies where accounting and records keeping procedures are complex and easily manipulated. Often, only company insiders know the true story of why or how a corporation cheated the authorities by using shell companies or hiding funds in international tax havens such as Panama to conceal their true earnings. In fact, international tax schemes may be costing the federal government (and American taxpayers) as much as $160 billion every year. The IRS lacks the resources to uncover these sophisticated scams and relies on whistleblowers to help them through the investigations.

How to report tax fraud with the IRS Whistleblower Program

After the success of the False Claims Act, the IRS created its Whistleblower Office in December 2006. This Rewards Program pays a percentage of the recovery between 15% and 30% of the total amount reclaimed to those who blew the whistle, and resulted in more than $25 billion in recoveries by the U.S. government. Individuals may anonymously report any type of tax fraud ranging from underpayment and negligence to outright evasion by hiring an attorney who will act as their proxy.

Why should you choose us to help you fight against Tax fraud?

Finding a competent lawyer to help you report a crime to the IRS is mandatory to maximize your award. We played a crucial role in helping many plaintiffs secure some of the most notable whistleblower settlements in the history of our country. Our team includes some of the most famous personalities in whistleblowing that will help you during the investigation and trial phases.

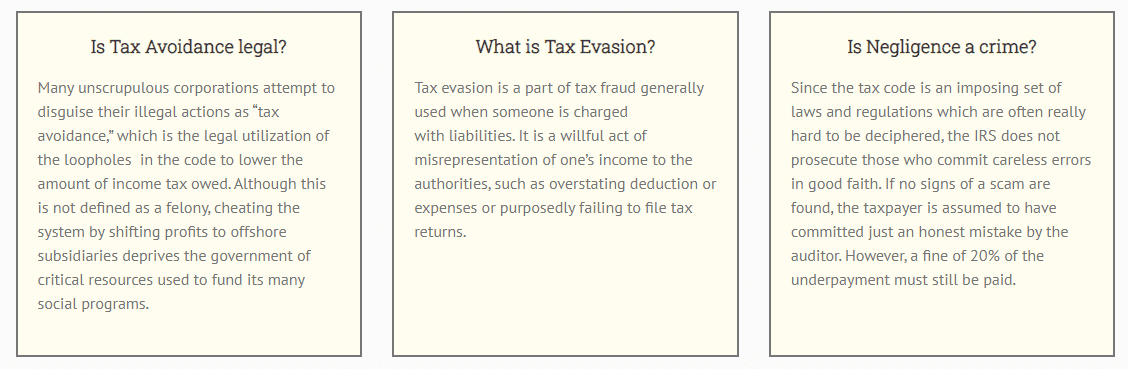

Types of Tax Fraud

Famous Cases of Tax Fraud

G.B. Enterprises False Deductions

In 1996, G.B. Enterprises filed a fraudulent return where it included over $5 million in improper deductions. For over 8 years, the car dealing company exaggerated its sales commissions by $56,879,852 to artificially create a larger tax penalty. In June 2004, G.B. eventually agreed to pay $36.5 millionfor tax fraud offenses.

The UBS Bank

In 2009, UBS settled with the IRS for $780 million following claims that it had unlawfully aided U.S. citizens in hiding their assets in Swiss bank accounts. A whistleblower who contributed to the investigation received a $104 million reward for the information he provided.

Falsified Records

UPS paid $25 millionto the U.S. Department of Justice and an additional $4.2 million to pay a whistleblower suit that claimed the shipping business falsified delivery records for government packages.

Is your case going to be successful in court?

If you took part or witnessed any widespread fraudulent behavior within your workplace, you may take the first step and become a whistleblower. However, not every claim is valid in court, so in order to increase your chances of success you need to substantiate your claims with privileged information or physical evidence.

Take the first step

If you or someone you know has information about tax fraud, our expert legal team will conduct a free case evaluation to help you better understand your legal options and what you can expect should you decide to file a whistleblower claim.

If you delay in filing a claim it can weaken your case and reduce your potential reward, so we urge you to contact us by filling out a formor calling toll-free at (800) 689-8552. Your first consultation is freeand confidential.

your information is safe with us:

-

Focused on Creating a Better World

Whistleblowers International exists to help whistleblowers with strong information and evidence of wrongdoing against the government bring whistleblower lawsuits, and ultimately to help the next generation avoid these experiences and to prevent future victims. That's what "Committed to Global Transparency" means to us.

-

Practicing with Open Ears and Open Minds

We are familiar with the intricacies of these cases. You may not know exactly what kind of case your information might pertain to or what exact significance it has. We're the experts in this area and what to decipher that on your behalf. Whistleblower cases are extremely complex and your information may qualify you to initiate a legal action under one of the many kinds of governmental whistleblower programs that exist in the US.

-

A Rare Law Firm of Pure Whistleblowers

There are many law firms that represent whistleblowers, but very few law firms keep whistleblower cases as their sole focus in the way that we do. We've done this for decades, and we are eager to speak with you.

-

Unmatched Wealth of Knowledge in This Area

Dr. Joe is both a medical doctor and a licensed attorney who has been in the whistleblowing arena for over 30 years as both a consultant and a whistleblower himself. We want to hear you and see how we can help.

Speak UP. Take Action.

See if We Can Help You with a Whistleblower Legal Action.General Whistleblower news:

-

SEC Awards $250,000 to Two Whistleblowers

- Whistleblower News

One of the best tools the Securities Exchange Commission (SEC) has to help reduce fraudulent activities and protect investors is its Whistleblower Program, which provides a reward of 10%-30% of monies ...

Read More -

Money laundering, the art market, and the proposed ENABLERS Act

- Whistleblower News

Money laundering is the act of concealing the origins of money, usually of criminal origin. When people obtain funds from criminal endeavors, they must find ways to use the money in a non-suspicious ...

Read More -

Theranos whistleblower exposes widespread healthcare fraud

- Whistleblower News

The whistleblower who exposed the healthcare fraud occurring at Theranos Inc. reports a vast scheme used to manipulate lab tests and quality-control checks. Tyler Shultz is the grandson of George P. ...

Read More