SEC Whistleblower Program

The Securities and Exchange Commission (SEC) Whistleblower Office is a program that protects and grants anonymity and rewards to those who come forward to expose financial and security frauds. As the responsibility held by unscrupulous corporations in the 2008 market crisis became more widely known, the public and government officials called for increased regulations and policing of Wall Street. In response, the Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010. This Act introduced comprehensive regulatory changes and consumer protection tools aimed at uncovering fraudulent schemes before they cause substantial economic damage.

The complexity and secrecy of Wall Street’s operations, coupled with powerful lobbying interests, makes effective government oversight and regulation difficult. As a result, insiders who blow the whistle have become an integral part of the legal enforcing required to maintain a fair market. Thanks to the information provided by many brave relators, the SEC has successfully collected billions of dollars from companies who have violated securities laws.

SEC Whistleblower Protections

The SEC programallows an individual to file a claim anonymously by using an attorney as his legal representative. The Dodd-Frank Act also prohibits the office from even revealing details that could identify the relator during the investigation. The claim is submitted anonymously by the lawyer who completes a Tip, Complaint or Referral (TCR) Form. The statute also protects whistleblower against any retaliation he might encounter as a consequence of his litigation. This protection also extends to employees of any subsidiary or parent corporation of the company suspected of violating the securities laws.

Anti-Retaliation Provisions

In the event a whistleblower is fired demoted or otherwise faces retaliation because he filed or even just considered filing a SEC action, the Dodd-Frank Act further extend its protection by allowing him to bring a lawsuit in federal court against the employer for wrongful discrimination. If it is found that the employee did face retaliation, the plaintiff is entitled to double back pay with interest , reinstatement to their former position (in cases of termination or demotion), compensation for their litigation costs including attorney’s fees, and possibly even a higher position overall. The program’s Anti-Retaliation provision also protects those who did not work directly for the fraudulent company but rather were employed as agents such as accountants, bankers, or salesmen.

SEC Whistleblower Rewards

Those who report a violation are entitled to receive a reward as long as the authorities successfully recover more than $1 million. This award ranges from 10% – 30% of the total amount recollected when the investigation is over. This reward system means that the minimuma successful whistleblower can receive is $100,000 and that the maximum payout can be millions of dollars (sometimes up to $30 million).

Securities Fraud Examples

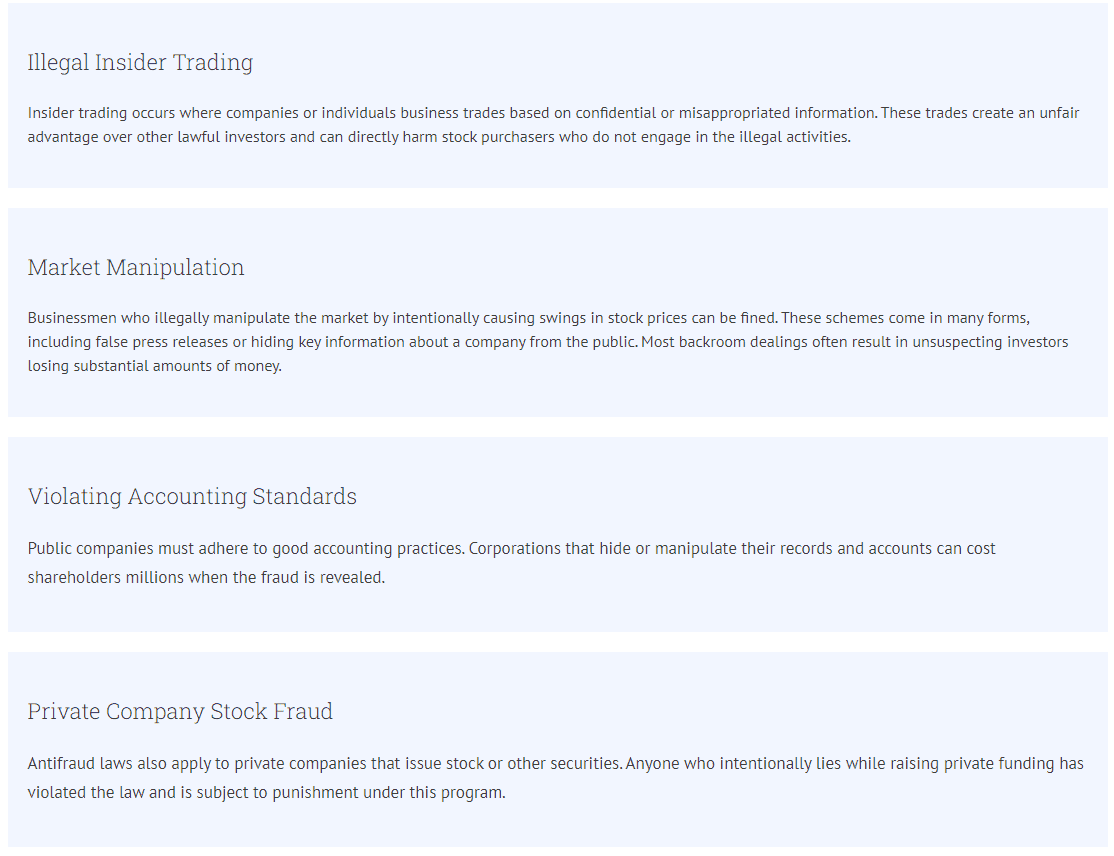

There are several types of illegal schemes that the SEC regularly encounters and investigates. Usually, only individuals with insider information are in a position to identify the exact actions and people involved in an ongoing scam. Here are some common examples.

The most common securities laws violations include:

Prominent Cases

Although the program is still in its infancy, the SEC Office of the Whistleblower has already rewarded over $78 million to 30 relators. Nearly a third of the total awards have been announced since May, 2016.

On October 1, 2013, a whistleblower received $14 million for reporting information that helped the authorities recover substantial investor funds from an investment advisor. This was the first successful multi-million dollar reward in the office’s history.

On April 28, 2015, the government charged Paradigm Capital Management after it learned that the company retaliated against a citizen who blew the whistle. The victim received over $600,000.

On January 15, 2016, the first award was paid to an outsider who had never worked for the company. The relator received $700,000 for submitting a high-quality analysis that uncovered violations of SEC regulations.

General Whistleblower news:

-

SEC Awards $250,000 to Two Whistleblowers

- Whistleblower News

One of the best tools the Securities Exchange Commission (SEC) has to help reduce fraudulent activities and protect investors is its Whistleblower Program, which provides a reward of 10%-30% of monies ...

Read More -

Money laundering, the art market, and the proposed ENABLERS Act

- Whistleblower News

Money laundering is the act of concealing the origins of money, usually of criminal origin. When people obtain funds from criminal endeavors, they must find ways to use the money in a non-suspicious ...

Read More -

Theranos whistleblower exposes widespread healthcare fraud

- Whistleblower News

The whistleblower who exposed the healthcare fraud occurring at Theranos Inc. reports a vast scheme used to manipulate lab tests and quality-control checks. Tyler Shultz is the grandson of George P. ...

Read More